Finding the Best Property Investment Opportunities in Dubai

Dubai’s real estate market is known for its strong growth, making it a prime destination for investors worldwide. At SmartCrowd, our mission is to make

Dubai’s real estate market is known for its strong growth, making it a prime destination for investors worldwide. At SmartCrowd, our mission is to make

Dubai’s real estate market is known for its strong growth, making it a prime destination for investors worldwide. At SmartCrowd, our mission is to make real estate investment opportunities in

When we look at Dubai, we see the glittering lights, the towering skyscrapers, and the luxury lifestyle – but what about the numbers? If you’re looking to invest in Dubai

We’re proud to announce that we recently signed an MoU with RTA, marking an innovative step in the region to establish a blockchain-powered digital platform.

From affordable areas like Dubailand to luxurious hotspots like Zaabeel, find out where you should be investing in Dubai for the highest yields in 2024.

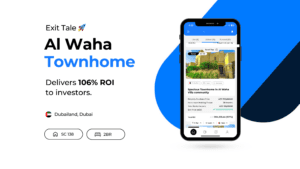

Explore our latest exit tale featuring our 25th success story in Al Waha, Dubailand. Find out how we delivered over 100% ROI in just three years!

Learn how to confidently make an investment in Dubai through fractional property investment so you can diversify your portfolio, and enjoy hassle-free returns.

Subscribe to our Smart Insights blog and get weekly updates on everything related to Dubai’s booming real estate market.

SmartCrowd allows you to start investing in Dubai’s booming property market, build your own rewarding real estate portfolio, generate a passive income, and enjoy remarkable returns. Through SmartCrowd, you can reap all the benefits of direct real estate investments (i.e., by owning the properties) and reduce your risk by allocating your capital across a number of properties all through an award-winning digital platform.

RISK WARNING: Investments in property and unlisted shares carry a risk. Your capital may be at risk and you may not receive the anticipated returns. This is not investment advice. These estimates are based on past performance and current market conditions which cannot be regarded as an accurate indicator of future results. You should do your own due diligence or consult with an independent third-party advisor. Where Investment declines in value or is not repaid, you will still need to meet your repayment obligations. Please review the full set of risk disclosure.

Numbers and returns mentioned are of past performances and not indicative of the current market unless highlighted and promoted as such.

To provide the best experiences, we and our partners use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us and our partners to process personal data such as browsing behavior or unique IDs on this site and show (non-) personalized ads. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Click below to consent to the above or make granular choices. Your choices will be applied to this site only. You can change your settings at any time, including withdrawing your consent, by using the toggles on the Cookie Policy, or by clicking on the manage consent button at the bottom of the screen.